Arizona Exemptions in Bankruptcy

What Property Exemptions in Arizona Bankruptcy?

What are bankruptcy exemptions?

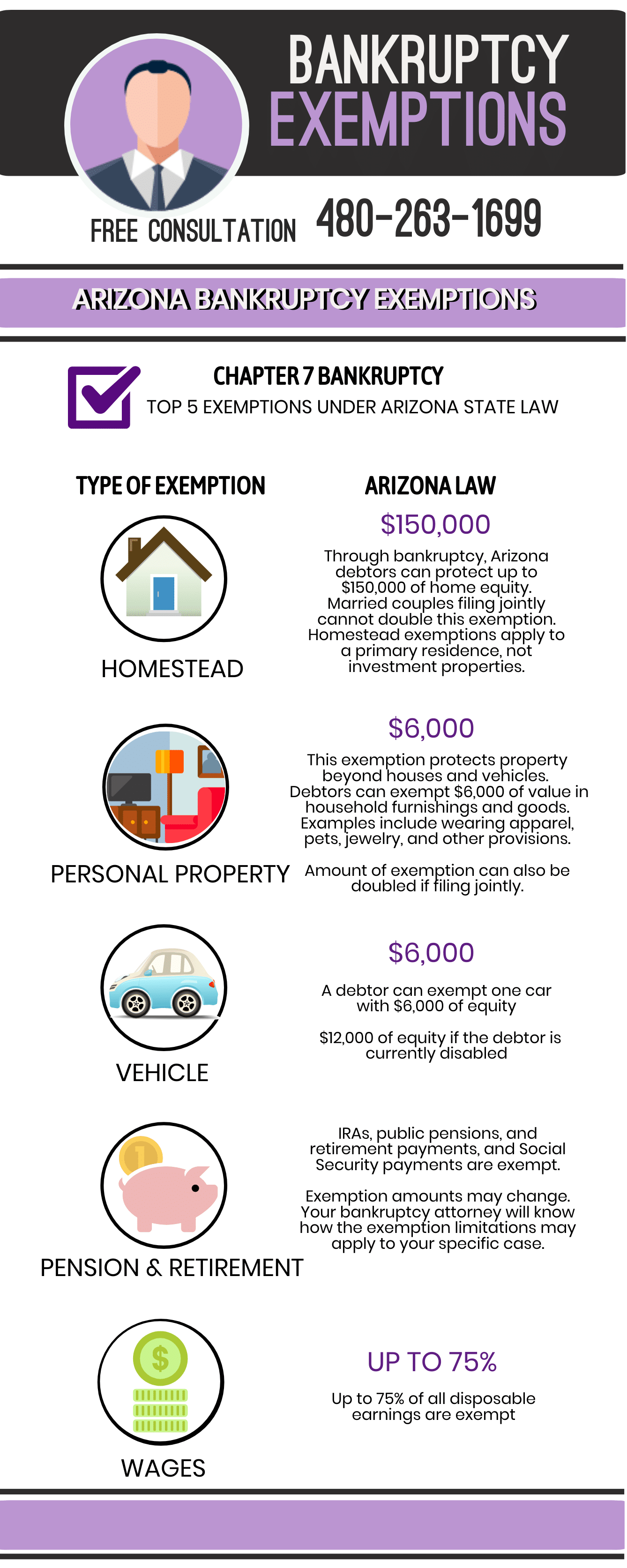

Bankruptcy exemptions are limits on the values of your assets. When you a file a Chapter 7, any assets worth more than the applicable exemption amounts will be sold, with the excess portion contributed towards your debts. Each state has different exemptions and you won’t necessarily be using the exemptions of the state you physically file in. You will use the exemptions of whichever state in which you spent the majority of the last 180 days.

When contemplating filing for bankruptcy in Phoenix or Arizona, one of the main concerns people face is the fear of losing property and belongings. It simply isn’t true that you are going to lose everything and be left on the street with nothing. This is a common myth about filing for bankruptcy protection.

The U.S. Bankruptcy Code was not written so that people who find themselves in financial difficulty are left with nowhere to turn after bankruptcy. In fact, the intention of bankruptcy is to give debtors a fresh start, which includes being able to keep certain essential property so that you can stay on your feet.

Exempt and Nonexempt Property

Property that you are paying back is not taken at all in a Chapter 13 bankruptcy filing as you are paying back your debt over time. In an Arizona Chapter 7 bankruptcy filing a person’s nonexempt property is sold and the funds are distributed to your creditors to satisfy your debt. However, you can keep your exempt property in a Chapter 7 bankruptcy filing.

Are Arizona bankruptcy exemptions different than other states?

Yes. Some states will allow you to have more equity in your home and vehicle, while others will allow less. Arizona has specific exemptions for belongings such as firearms ($2,000), clothing ($500), and a watch ($250), that will vary from state to state. Arizona doesn’t have a wildcard exemption like states such as California, which allows filers that don’t own their home to exempt over $30,000 on an asset of their choosing. If you have recently moved, you should consult with an attorney to see if your assets can be protected under both states’ exemptions to determine when you should file.

Debts and Assets

When filing bankruptcy in Arizona it requires you to list not only all of your debts but all of your assets. The most popular chapter of bankruptcy that is filed is a Chapter 7 Bankruptcy or a “Liquidating Bankruptcy”. In a chapter 7 bankruptcy; if you have non-exempt property there is a real possibility that it could be seized and sold at auction with the money going to your creditors. This does not apply to exempted property in an Arizona Chapter 7 bankruptcy filing.

However, in Arizona there are laws known as exemptions that protect your property. Most people have heard of the homestead exemption that protects your home, but most are unaware that there are numerous other exemptions in Arizona that protect everything from your car to your bible to your shotgun.

Free Consultation

To get a better understanding of filing for bankruptcy protection, the differences between Chapter 7 and Chapter 13 bankruptcy, and what things might be exempted while filing for bankruptcy, contact an Arizona bankruptcy lawyer for a free consultation. Call (480) 263-1699 and get yourself on the road to a “Fresh Start” right away.

Is there a homestead exemption in Arizona?

Yes. The homestead exemption in Arizona is $150,000. This exemption is the same for single and married filers. If your home is at or about the exemption amount, you should discuss your options with a bankruptcy attorney. You can still file a Chapter 13 bankruptcy if your home is too valuable. This allows you to reorganize your debts and pay them over 3-5 years. See our other articles for more information on Chapter 13 bankruptcy.

What is a vehicle exemption? How does that apply to Arizona bankruptcy exemptions?

A vehicle exemption is the amount of equity you can have in your car. In Arizona, a single filer can have up to $6,000 equity in one vehicle. Married filers may have two vehicles with up to $6,000 equity each, or one vehicle with up to $12,000 equity. The exemption is higher for filers with disabilities that require wheelchair-accessible vehicles.

What are the bankruptcy income exemptions?

To qualify for a Chapter 7 bankruptcy, you must either make below your state’s median income level for your family size, or pass a means test. Your family size will include spouses and minor children, but not unwed partners and adult children. In Arizona, the median income level for a single filer with no dependents is $51,358. As you add a family member, it increases to $64,543, $70,428, and $85,403. If you make more than the median income level for your family size, you will have to prove through the means test that you have no disposable income left at the end of the month to pay your debts.

File Now … Pay Later!

Phoenix bankruptcy attorneys serving Chapter 7 and Chapter 13 clients in Phoenix and surrounding communities!

Lastly, please consult a bankruptcy attorney in Phoenix for advice about your individual situation. This site and its information is not legal advice, nor is it intended to be. Please contact us via email, phone calls, or letters and we will gladly speak with you. In doing so, this does not create an attorney-client relationship. Until we have established an attorney-client relationship, please do not send any confidential information to us. We look forward to assisting you.